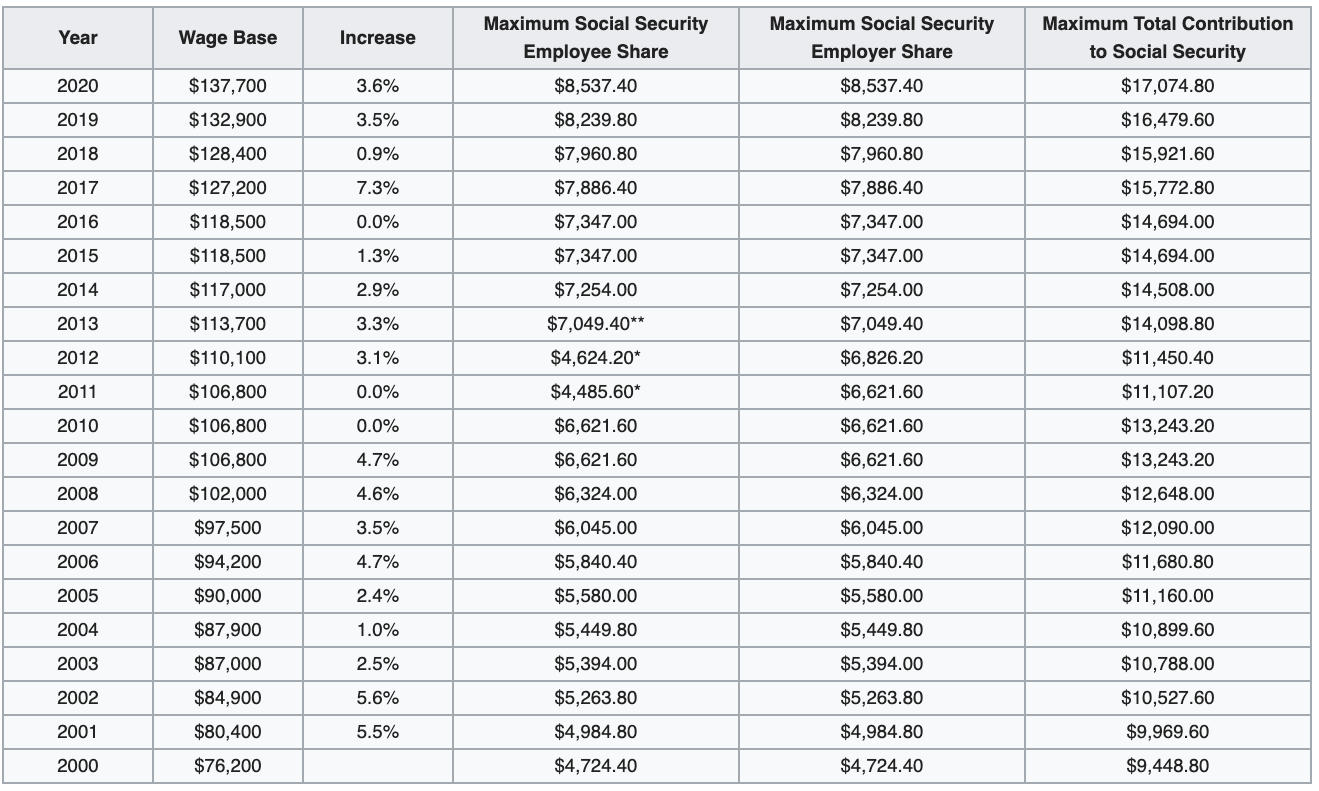

What Is The Social Security Tax Rate For 2024. The oasdi tax rate for wages paid in 2024 is set by statute at 6.2 percent for employees and employers, each. Of course, both employers and employees pay the 6.2% social security tax rate, which means there could be a max payment next year of:

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an. However, if you’re married and.

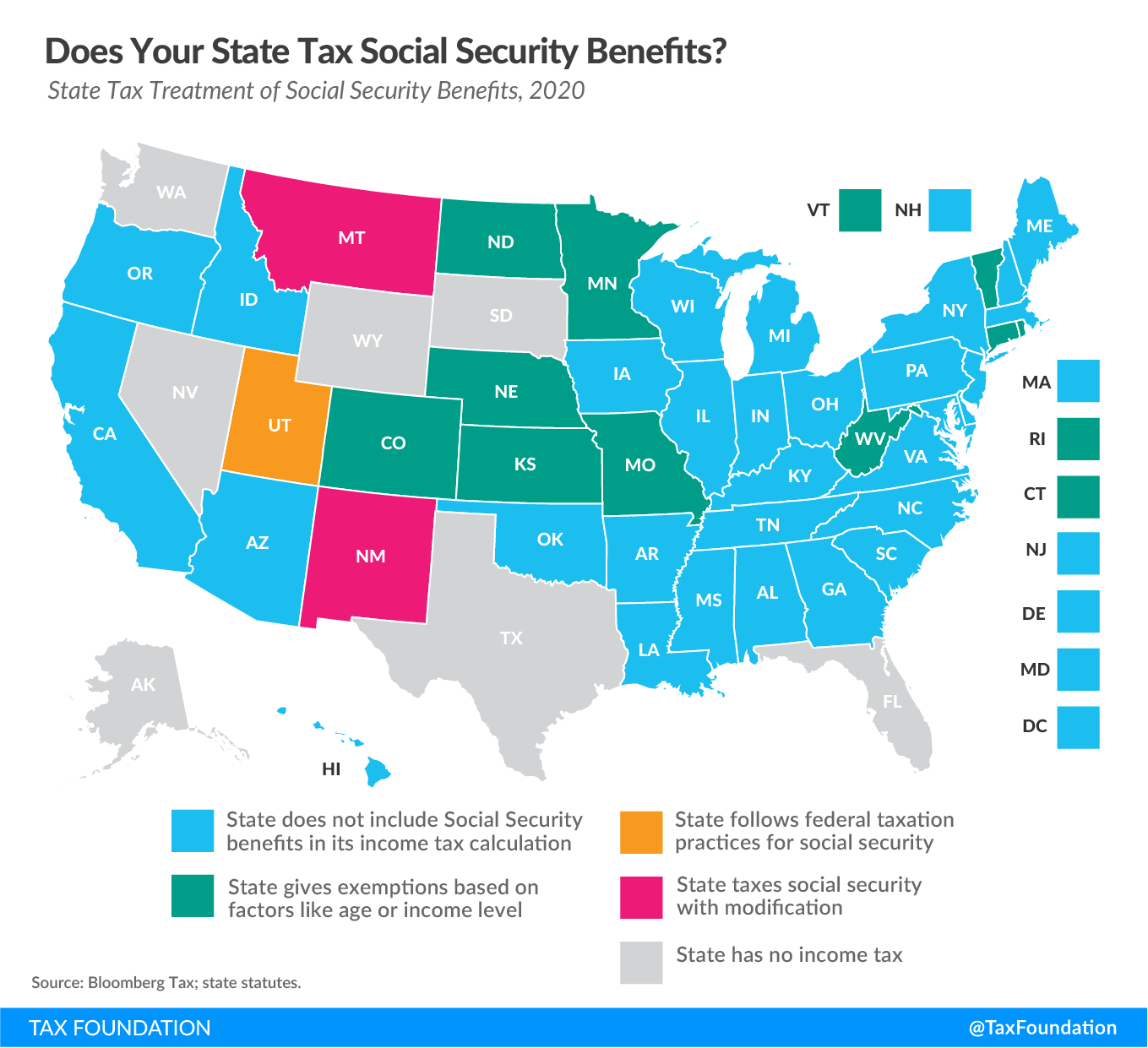

Social Security Payments Are Also Subject To State.

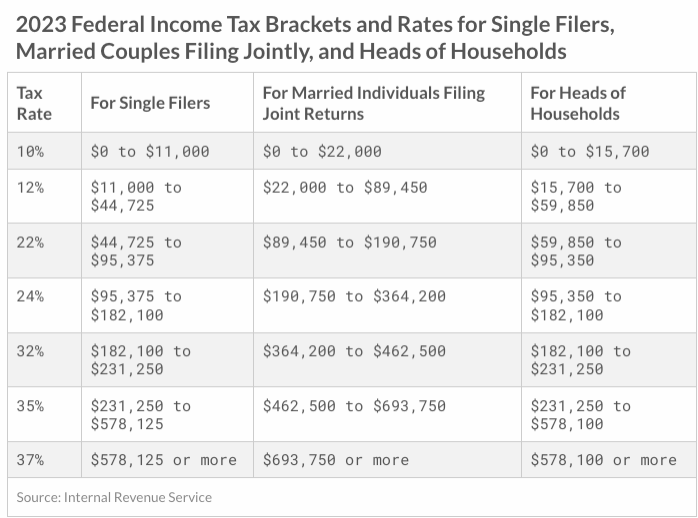

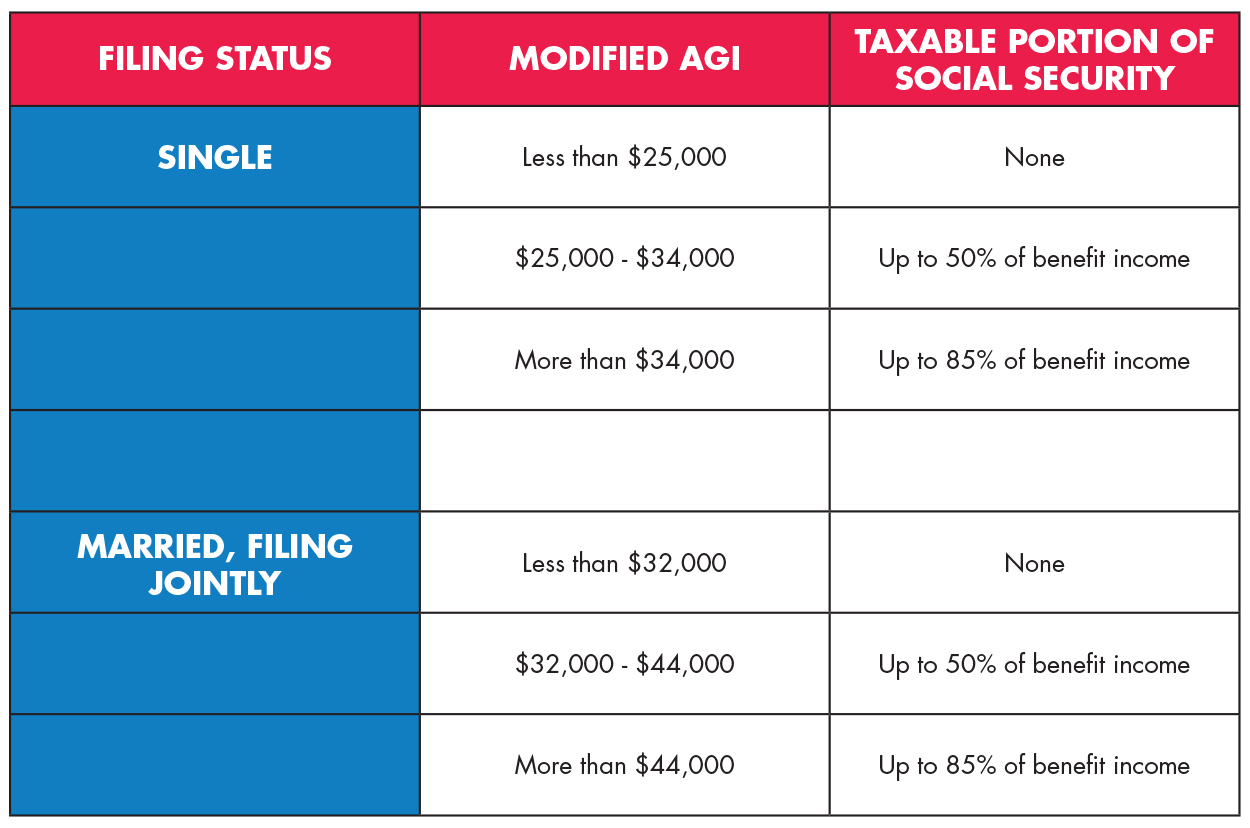

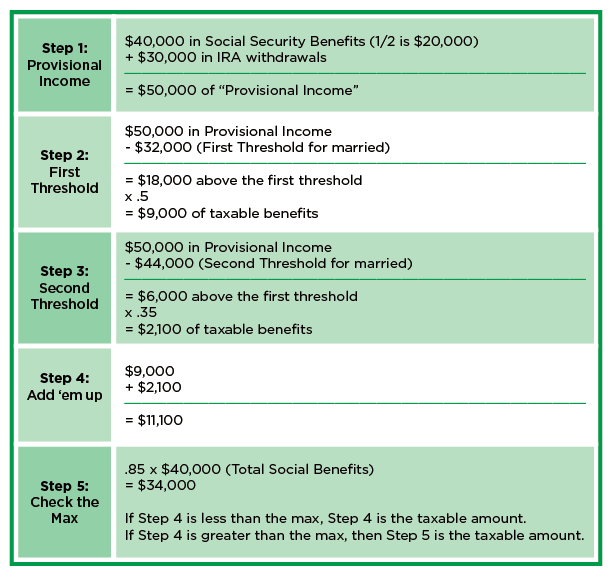

Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

Up To 50% Of Your Social Security Benefits Are Taxable If:

The state tax rate spans from 2.36% to 5.12%.

What Is The Social Security Tax Rate For 2024 Images References :

Source: elitabdorelle.pages.dev

Source: elitabdorelle.pages.dev

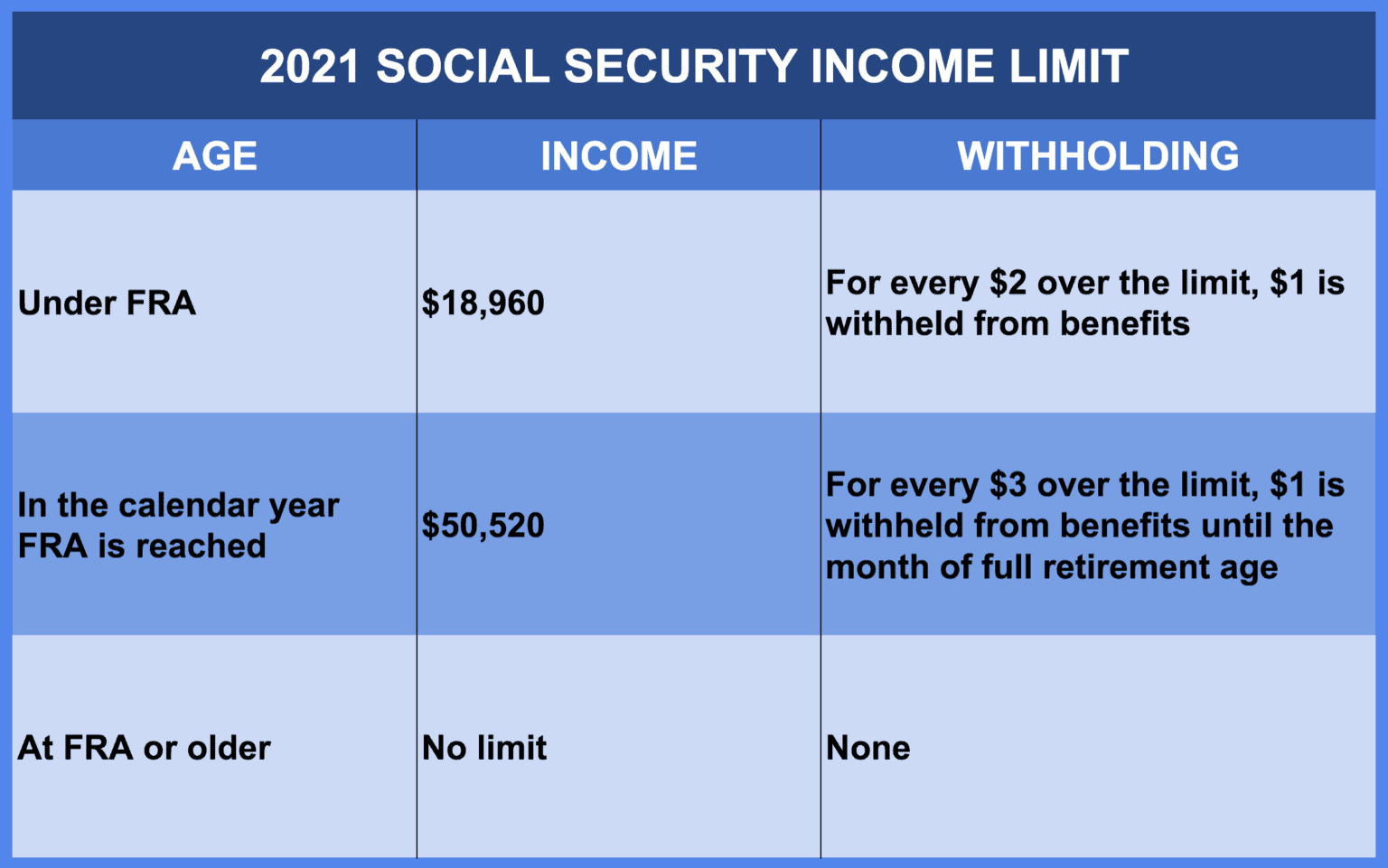

Social Security Tax Limit 2024 Withholding Chart Mavra Sibella, Social security is subject to state income taxes in certain situations. Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

Source: reynaqaurelea.pages.dev

Source: reynaqaurelea.pages.dev

Maximum Social Security Tax Withholding 2024 Olympics Elane Xylina, Up to 50% of your social security benefits are taxable if: As its name suggests, the social security tax goes to the social security program.

Source: filiaqmarney.pages.dev

Source: filiaqmarney.pages.dev

Employer Social Security Tax Rate 2024 Maggee, Social security tax limit jumps 5.2% for 2024; Social security taxes in 2024 are 6.2 percent of gross wages up to $168,600.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The social security portion is taxed at 6.2% on earnings up to the maximum taxable amount, while the medicare portion is taxed. Up to 50% of your social security benefits are taxable if:

Source: danajerrine.pages.dev

Source: danajerrine.pages.dev

Social Security Max 2024 Tax Lucia Florida, Social security and medicare tax for 2024. Social security tax limit jumps 5.2% for 2024;

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: sisilewamabel.pages.dev

Source: sisilewamabel.pages.dev

Social Security Full Retirement Age 2024 Lynea Rosabel, The social security wage base limit is. This online social security benefits calculator estimates retirement benefits based on your age, retirement date and earnings.

Source: bernadettewlotti.pages.dev

Source: bernadettewlotti.pages.dev

Social Security Wage Base For 2024 Meara Sibylla, However, if you’re married and. The tax rate for an employee's portion of the social security tax is 6.2%.

Source: caribannadiana.pages.dev

Source: caribannadiana.pages.dev

Annual Social Security Tax Cap 2024 Rae Leigha, How retirement income is taxed by the irs; Social security is subject to state income taxes in certain situations.

Source: elissaqnatasha.pages.dev

Source: elissaqnatasha.pages.dev

How Much Is Social Security Tax In 2024 Wynny Dominica, For an individual, the tax rate is 6.2% of earnings, with their employer paying another 6.2% into the. The 2023 and 2024 limit for joint filers is $32,000.

Source: www.praiadarochauncovered.com

Source: www.praiadarochauncovered.com

Social Security Tax Rate 2024, What is the social security tax rate in 2024? The tax rate for an employee's portion of the social security tax is 6.2%.

Specifically, 12 States Taxed Social Security Income In 2023, But Only 10 States Will Tax Social Security.

Fifty percent of a taxpayer's benefits may be taxable if they are:

Social Security And Medicare Tax For 2024.

An individual who earns under $168,600 in 2024 pays a 6.2% social security tax rate on their entire income.